Build Your Wealth the Smart Way: A Canadian's Guide to Low-Cost Investing.

Join over 3 million Canadians using Wealthsimple and learn the simple ETF strategy to skip high-fee mutual funds and build long-term wealth.

Start Investing & Get $25Commission-free trading. Simple setup. Your first step to financial freedom.

An Honest Guide from One Canadian Investor to Another

Hi, I'm Shane. This guide started when I discovered a simple, frustrating truth: my parents were paying over 2% in fees at their big bank, long after far better, low-cost options had become available.

That's what started my mission. I dove into the principles of low-cost investing from Canadian experts like Ben Felix and the Canadian Couch Potato, then set out to find the single best platform to put that theory into practice. I went hands-on with all the major players: bank brokerages (RBC, TD), online contenders (Questrade, eToro), and advanced platforms (IBKR).

My research led me to one clear conclusion: Wealthsimple.

It’s the platform I ultimately used to help my parents switch. It's where I invest my own money, and it's the only service I trusted enough to recommend to my wife, siblings, and friends. My recommendation is earned, not paid for—I have no formal partnership with Wealthsimple. I just believe it's the best tool for the job. Full transparency: If you find this guide helpful and choose to sign up through my link, I may receive a small bonus at no cost to you, which helps support this site.

Are Your Bank's Mutual Funds Secretly Costing You a Fortune?

The Problem: High-Fee Active Mutual Funds Investment funds managed by professionals who try to outperform the market by picking stocks they believe will perform well. Often come with high fees.

- High fees significantly reduce your returns.

- Vast majority underperform Fail to match or exceed the returns of a benchmark index, like the S&P/TSX Composite, over the long term. their benchmarks.

- Often lack transparency in holdings and costs.

- Hidden trading expenses Costs incurred when buying or selling securities within the fund, further reducing overall returns. add up.

The Hard Truth: SPIVA Data

The SPIVA Canada Year-End 2023 report reveals a stark reality: over 10 years, a vast majority of active funds failed to beat their benchmarks:

- 97% of Canadian Equity funds

- 98% of Canadian Focused Equity funds

- 98% of U.S. Equity funds

In simple terms: If you and 99 friends invested in different Canadian equity mutual funds 10 years ago, 97 of you would have earned more money in a simple, low-cost index ETF.

The Solution: Low-Cost Index ETFs Exchange-Traded Funds that track a specific market index (like the TSX or S&P 500). They offer broad diversification at a very low cost.

- Keep significantly more of your money with ultra-low fees.

- Instant diversification Spreading your investment across many companies and regions to reduce risk. Don't put all your eggs in one basket! across global markets.

- Track market performance consistently over time.

- Simple and transparent – know what you own.

"By periodically investing in an index fund, the know-nothing investor can actually out-perform most investment professionals."

- Warren Buffett

The "One-Click" Portfolio: A Simpler Way to Invest

Imagine owning a fully diversified, global portfolio of thousands of stocks and bonds, all managed and rebalanced for you automatically, for a fraction of the cost. That's exactly what an All-in-One ETF does. They are the easiest way to invest with a single purchase, automatically managing the mix of stocksShares of ownership in companies, aiming for growth. and bondsLoans to governments or companies, aiming for stability and income. for you.

Why Choose All-in-One ETFs?

- Instant global diversification.

- Automatic rebalancingMaintaining your desired stock/bond mix automatically over time. – no manual adjustments needed.

- Extremely low Management Expense Ratios (MERs)The all-in annual fee for a fund, shown as a percentage. Lower is better! All-in-one ETFs are typically around 0.20%, while bank mutual funds can be 2% or more..

- Buy and sell easily like a stockThis action, called a 'trade', often has a fee called a commission (~$10 at big banks). A key advantage of platforms like Wealthsimple is that they offer commission-free trading for Canadian ETFs..

- Perfect for beginners and hands-off investors.

Choosing Your Risk Level

Your mix depends on your investment timeline and comfort with volatilityHow much an investment's price might swing up or down..

- More Stocks: Higher potential growth, higher volatility (Good for long-term: 10+ years).

- More Bonds: Lower potential growth, lower volatility (Good for shorter-term or lower risk tolerance).

Which ETF Should You Choose?

In Canada, the main providers of these ETFs are

Vanguard

,

iShares (by BlackRock)

, and

BMO

. They all offer excellent, low-cost options, and the most important decision is choosing any

of them over a high-fee bank fund.

Your personal choice depends on your timeline. Generally, investors with decades until retirement lean towards Growth (80/20)

or All-Equity (100/0)

portfolios. Those nearing or in retirement often prefer Balanced (60/40)

to reduce risk. To find your ideal fit, I highly recommend taking the 2-minute Vanguard Investor Questionnaire

.

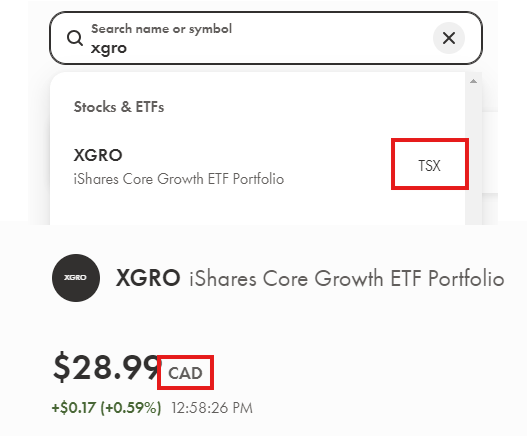

To keep it simple, my suggestion for an excellent starting point is a Growth ETF like XGRO

. I personally use the iShares X-series for my own portfolio; they're low-cost (0.20% MER) and highly effective.

- 100/0 (All Equity): VEQT, XEQT, ZEQT

- 80/20 (Growth): VGRO, XGRO, ZGRO

- 60/40 (Balanced): VBAL, XBAL, ZBAL

- 40/60 (Conservative): VCNS, XCNS, ZCON

- 20/80 (Income): VCIP, XINC

Comparisons use VGRO/XGRO/ZGRO vs. RBF459 (sample bank fund) as of August, 2024.

*Max 5-year performance shown due to ZGRO's Feb 2019 inception.

The Million-Dollar Difference: See How Fees Impact *Your* Growth

Key Fees Explained

Management Expense Ratio (MER)

Annual fee charged by the ETF/fund provider (e.g., 0.20%). Deducted automatically from returns.

Commissions (Trading Fees)

Fee paid to the brokerage per trade (buy/sell). Often $5-$10 at big banks.

Monthly Bank Account Fees

A separate monthly fee just for having a chequing account. Typically $15+ at big banks.

Fee Impact Calculator

How Fees Erode Your Growth (7% Annual Return Assumed)

Wealthsimple:

$0

Bank ETF:

$0

Bank Mutual Fund:

$0

By switching, you could have:

$0 more

(0% more growth)

Start Saving on Fees Now*Assumes twice-monthly purchases/commissions ($20/mo) where applicable. Bank fees are applied monthly.

Step 1: Replace Your Bank, Eliminate Fees

Wealthsimple starts by replacing your expensive bank accounts with a single, elegant app that pays you—instead of charging you.

| Feature | Wealthsimple | Typical Big Bank |

|---|---|---|

| Monthly Chequing Fee | $0 | $15 - $30 |

| Out-of-Network ATM Fee | $0 (Reimbursed) | $2 - $5 per use |

| e-Transfers® | Free & Unlimited | Often Limited |

| Interest on Cash | Up to 2.5%* Rates (subject to change): Core (1.5%), Premium (2.0%), Generation (2.5%). Core/Premium clients can get a 0.5% boost with an eligible direct deposit of $2k+/month. | ~0.05% |

Beyond the savings in the table, you also get powerful features like getting your paycheque up to two days early and no minimum balance requirements to waive fees.

Bank-Level Security & Insurance: Your money is safe. Wealthsimple provides the same robust protection as major Canadian banks, with CIPF coverageCanadian Investor Protection Fund. Protects your investment accounts up to $1 million per account type if your brokerage firm becomes insolvent. It does not cover market losses. protecting your investments and CDIC insuranceCanada Deposit Insurance Corporation. While the standard coverage is $100,000 per institution, Wealthsimple holds your cash across multiple partner banks to extend your eligible deposit insurance up to $1 million. for your cash deposits.

Step 2: Invest Smarter, Build Wealth

Once you've cut your bank fees, Wealthsimple provides a powerful toolkit to build your long-term wealth automatically.

Core Investing Features

-

No Trading Commissions

Buy and sell Canadian-listed stocks and ETFs with zero commission fees, saving you ~$10 on every single trade. -

Automate Everything

Set up recurring buys for any stock or ETF and automatically reinvest your dividends (DRIP) to put your portfolio on autopilot. -

Fractional Shares

Invest in any company with as little as $1. You don't need thousands of dollars to own shares in big-name companies.

Advanced Investing Features

As you grow more confident, you can use powerful tools like a margin account, which provides an on-demand line of credit against your investments at low interest rates from 4.2% - 5.2%*Borrowing rates depend on assets (subject to change): Core (<$100k): 5.2%, Premium ($100k+): 4.7%, Generation ($500k+): 4.2%. Rates are variable..

A Standout Feature: Link TFSA

Wealthsimple offers a standout feature that lets you link your TFSA to your margin account. This can increase your available buying power by using your TFSA as additional collateral.

This is an advanced feature with significant risk: if you get a margin call, Wealthsimple has the right to sell assets from your TFSA to cover your debt.

Accounts & Getting Started

Choosing the Right Account

Invest within tax-advantaged accounts first!

-

TFSA (Tax-Free Savings Account)

Invest after-tax dollarsMoney you've already paid income tax on., all growth and withdrawals are tax-free. Flexible contribution roomStarts at age 18, limit changes annually ($7,000 for 2024). Unused room carries forward. Check CRA My Account for your limit.. Often the best starting point.

Learn more at Wealthsimple → -

RRSP (Registered Retirement Savings Plan)

Contributions are tax-deductibleReduces your taxable income now., growth is tax-deferred. Withdrawals are taxed. Good for higher earners aiming for retirement savings. contribution roomBased on 18% of previous year's income, up to a max ($31,560 for 2024 tax year). Check your Notice of Assessment. depends on income.

Learn more at Wealthsimple → -

FHSA (First Home Savings Account)

Combines TFSA & RRSP benefits for a first home purchase. Tax-deductible contributions, tax-free growth & withdrawals for home purchase. contribution room$8k/year limit, $40k lifetime max. Can carry forward $8k unused room. Max 15 years. limited.

Learn more at Wealthsimple → -

Non-Registered Account

Use after maxing out registered accounts. No contribution limitsInvest as much as you want., but capital gainsProfits from selling investments. and dividendsPayments from companies to shareholders. are taxable.

Learn more at Wealthsimple →

Buying Your First ETF on Wealthsimple

- Sign Up for Wealthsimple (Use the link for a $25 bonus!). Choose "Trade stocks and ETFs" (Self-Directed Investing). Wealthsimple offers 'Managed Investing' (robo-advisor) and 'Self-Directed Investing' (Trade). This guide focuses on Self-Directed for buying ETFs yourself to minimize fees.

- Fund Your Account (Link bank account, e-Transfer, etc.).

- Search for the ETF ticker (e.g., "XGRO", "VGRO").

Check it's CAD & TSX.

Ensure the ETF is listed on the TSX and in Canadian dollars (CAD) to avoid currency conversion fees. Wealthsimple usually shows this clearly.

- Select "Buy". Choose order type: MarketBuys immediately at the best current price. Simple but price might fluctuate slightly. Wealthsimple requires a 5% cash buffer for market orders. or LimitSet a maximum price you're willing to pay per share. Order only fills at your price or better. Allows investing your full cash balance without a buffer..

- Enter amount (dollars or shares).

- Review and confirm your trade.

Already Investing Elsewhere?

Have an account at another bank? Wealthsimple makes transferring simple. They handle the paperwork and will reimburse the transfer-out fee for qualifying accounts over $25,000. Learn more here →

- Initiate the transfer inside the Wealthsimple app (Go to Move → Transfer an account).

- Provide your account details from a recent statement.

- Choose to transfer "in-kind"Moves your stocks and ETFs directly without selling them, keeping you in the market. Use this if you hold these at another brokerage (e.g., Questrade) or a bank's self-directed platform (e.g., TD Direct Investing). Mutual funds cannot be transferred this way. or "in cash"Your current institution sells your investments and moves the cash. This is the required option for moving any mutual fund account. You will be out of the market during the transfer, but can buy new ETFs once the cash arrives..

- Let Wealthsimple handle the rest (typically takes 1-4 weeks).

Stay the Course & Keep Learning

Keys to Long-Term Success

- Be Consistent: Set up regular, automatic investments (e.g., every payday).

- Be Patient: Investing is a marathon, not a sprint. Think long-term (5-10+ years).

- Stay Calm: Don't panic sell during market dips. Stick to your plan.

- Minimize Fees: Stick to CAD-listed ETFs on commission-free platforms like Wealthsimple.

- Know Your Timeline: Only invest money you won't need for at least 5 years. Markets fluctuate. A longer timeline gives your investments time to recover. For short-term savings (under 5 years), consider High-Interest Savings ETFs like CASH.TO or HISA/PSA funds within Wealthsimple.

- Seek Advice (If Needed): Consider fee-only financial adviceAn advisor you pay directly for their time/plan, not one who earns commissions selling you products. This avoids conflicts of interest. from a fiduciarySomeone legally obligated to act in your best interest. planner for complex situations.

"The stock market is a device for transferring money from the impatient to the patient."

- Warren Buffett

Recommended Resources

Continue your learning journey:

- Canadian Couch Potato Blog

- Canadian Portfolio Manager Blog

- r/PersonalFinanceCanada (Reddit)

- r/CanadianInvestor (Reddit)

- Ben Felix's YouTube Channel (Rational Reminder)

- Wealthsimple Learn

- Follow iCanInvest on X

Follow iCanInvest on Bluesky

Follow iCanInvest on Bluesky- iCanInvest YouTube Channel

Pro Tip: Automate!

Set up recurring investments in Wealthsimple ('Auto-Invest'). This enforces discipline and leverages dollar-cost averagingInvesting a fixed amount regularly, buying more shares when prices are low and fewer when high, potentially lowering your average cost over time.. Even small amounts add up significantly over time due to compounding!

Ready to Take Control of Your Financial Future?

You now understand the problem with high fees, you've seen the power of the simple ETF solution, and you know the best platform to do it on. The only thing left is to take the first, easy step.

Get $25 Bonus

Sign up and fund your new Wealthsimple account using the link below.

Zero Commissions

Keep more of your returns by avoiding trading fees on Canadian stocks & ETFs.

Simple & Powerful

An easy-to-use app with automated features to keep you on track.

(Takes just a few minutes)

Disclaimer: This website provides educational information only and is not financial advice. Investing involves risk. Past performance doesn't guarantee future results. Do your own research and consider consulting a qualified, fee-only financial advisor before making investment decisions. The site owner uses Wealthsimple and may receive a bonus if you sign up through the provided referral links, at no extra cost to you. You are free to sign up directly.

Contact: contact@icaninvest.ca